- The Timberland Investment Group (TIG), owned by investment bank BTG Pactual, is expanding its planted forest operations in the Cerrado. Its newest office is next door to the world’s soon-to-be largest paper and pulp factory, under construction.

- U.S. President Joe Biden pledged $50 million toward the initiative, claiming it would help conserve Latin America’s most critical ecosystems. The funds have not yet been released, but TIG has already started acquiring new land.

- From 2018-22, BTG Pactual financed $1.67 billion in forest-risky products including soy, beef, timber and pulp and paper, according to Forests & Finance data analyzed by Mongabay.

- The planted forest industry advertises environmental benefits and is increasingly joining bids for green finance. Critics say stored carbon is released after harvest and these monoculture plantations are distracting funds and attention away from real biome conservation.

Mark Wishnie felt pleased when he heard the news: Joe Biden announced his support of a $50 million debt investment for the timber farmland project he heads at Latin America’s largest investment bank.

The U.S. president’s April 20 speech at the Major Economies Forum on Energy and Climate boosted a $1 billion financing campaign by the Timberland Investment Group (TIG), a $5.6 billion subsidiary of BTG Pactual that buys up large swaths of land to grow and chop trees as an investment portfolio.

Biden promised funds from the U.S. International Development Finance Corporation to conserve the Amazon and other critical Latin American biomes. Congress has yet to approve the funds. But if it passes, the debt investment will largely be funnelled into mass-produced eucalyptus in Brazil’s Cerrado savanna, Mongabay found.

“The announcement was very helpful in highlighting the role of well-managed working forests in helping to deliver climate benefits,” Wishnie, chief sustainability officer at TIG, told Mongabay in a video interview.

The investment bank boasts carbon absorption by trees, but critics say the pulpwood industry’s aggressive expansion is polluting the air and water, drying the land, reducing biodiversity and uprooting communities. Also, once the trees are felled and turned to pulp, carbon is released again.

A target of 300,000 hectares (741,300 acres) of Cerrado land, the company told Mongabay, would be transformed into mostly commercial eucalyptus and pine tree farms. Half the land would be left for natural savanna regeneration, surpassing the legal requirement of 20%. The projected jump from 20-50% conservation, Wishnie said, would set a new bar for the industry and may also be financially compensated with climate funding.

The 50% conservation commitment does not extend to their existing portfolio of 1.7 million ha (4.2 million acres) of timberland in Latin America. TIG’s target includes only newly purchased land.

The first phase of the project is already underway: a 24,000-hectare (59,300-acre) former cattle ranch in the Brazilian state of Mato Grosso do Sul. The remaining 276,000 hectares (682,000 acres) will be acquired over the next five years as the Latin America Reforestation Strategy nears its $1 billion goal.

New frontiers

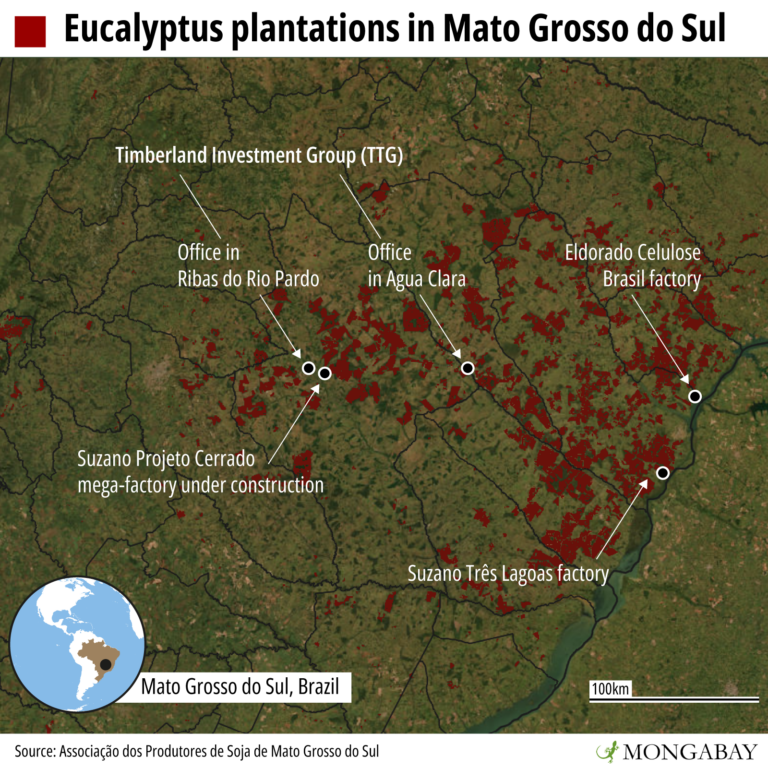

In 2021, TIG opened its newest office in a 25,000-person rural town called Ribas do Rio Pardo in the state of Mato Grosso do Sul via its subsidiary TTG Brasil.

Here, Suzano — Latin America’s leading paper and pulp company — is building the world’s largest eucalyptus fiber processing factory, with a projected annual cellulose production capacity of 2.3 million tons.

The factory, called the Cerrado Project, has garnered almost $4.5 billion in funding so far, up to $900 million of which comes from the World Bank’s International Finance Corporation, which has classed the project as high-risk.

“This is a Category A project,” IFC’s portal reads, “because it may cause significant adverse environmental and social risks and impacts that may be diverse and irreversible.” Risks listed include potential impacts on natural habitat and biodiversity, displacement of people, water and air emissions as well as population influx.

In December 2022, 40 NGOs sent a joint letter to the International Finance Corporation urging it to veto the loan.

“The expansion of pulp plantations to feed the mill is leading to decline of species richness and out-compete the remaining Cerrado stands,” the letter reads. “These plantations will also cause deforestation by using land previously converted by the cattle ranch industry and pushing it towards the deforestation frontier.”

In the nearby municipality of Três Lagoas, another three factories — two owned by Suzano, one by Eldorado Brasil — already produce more than 5 million tons of eucalyptus-based paper and pulp a year, fueled by the pulpwood plantations dominating the area.

In 2020, TIG opened another office in Água Clara, an even smaller town less than 100 kilometers (62 miles) away between Ribas do Rio Pardo and Três Lagoas. The two “strategically located” offices in Mato Grosso do Sul are where they are now acquiring new land.

Large investment funds now own roughly 90% of planted forests in Mato Grosso do Sul, Luiz Ramires Junior, president of the state’s Planted Forest Association of Producers and Consumers, told a local newspaper.

Within the next five years, TIG’s alleged reforestation strategy will bring its land control in Latin America to 2 million ha (4.9 million acres), an area almost the size of El Salvador.

BTG Pactual’s investments

From 2018-22, BTG Pactual financed $1.67 billion in forest-risky products including soy, beef, timber, pulp and paper and palm oil, according to Forests & Finance data analyzed by Mongabay.

Suzano presented the mega-factory project to BTG in May 2022; just as construction took off, the bank poured $67.6 million into Suzano through shareholding and bond issuance.

In 2021, another $63.5 million was issued in bonds to Eldorado Brasil Celulose, which also purchases eucalyptus from the region.

But BTG Pactual’s investments in paper and pulp are meek in comparison with its investments in beef, Brazil’s leading cause of deforestation in the Cerrado and Amazon biomes. In 2022, the bank poured $281.9 million into beef titans Minerva, Marfrig and JBS.

For critics, if large investment banks continue to fund climate-risky businesses such as Brazilian beef and pulp without more stringent criteria, the claims regarding reforestation efforts are empty.

The Forests & Finance policy assessment platform rates BTG Pactual at a 1.9 of 10, with even lower scores in the environment category.

“They haven’t done basic things like adopting a zero-deforestation policy, for example, or adopting a policy that says they will respect the free prior and informed consent from Indigenous and local communities,” Merel van der Mark, Forests & Finance Coalition coordinator, told Mongabay in a video interview. “I see it as greenwashing.”

Local impacts

Pasture-to-pulpwood shifts drive cattle ranching into other areas and the terrain preparation wipes out native vegetation remnants on ranches, a December 2022 report by the Environmental Paper Network found.

“The paper industry does not repair damage by restoring forests, as it commonly claims to do,” the report reads. “On the contrary, it destroys the surviving fragments of Cerrado which, thanks to its deep roots, tends to survive land conversion [from savanna to pasture].”

More than half of the native Cerrado biome has been cleared in the last three decades to make way for cattle ranching, soybean farming, eucalyptus plantations and sugarcane fields. Scientists predict the biome could collapse within 30 years. Deforestation increased by 25% last year, marking a seven-year high.

Frenzied demand for eucalyptus farms in the last two years is driving up prices and pushing ranchers to cheaper, deforestation-prone areas like the Amazon Rainforest. “It provides ranchers with financial means to buy larger areas of land in regions where land is cheaper,” the report stated.

Lack of transparency

The investment group refused to specify percentages of tree species, farm locations or conservation area percentages in its existing 308,000 ha (761,640 acres) of timber farmland owned in Brazil.

“The details are sort of the inside of your house. There are certain things that we can’t make public,” Wishnie told Mongabay. “Where we’re investing and the percentage [of land conserved] unfortunately I can’t disclose. As a bank, we have to protect our clients’ information.”

Accountability for their climate targets is partially monitored by Conservation International, an American nonprofit named as the project’s impact adviser. Mongabay identified institutional overlaps.

BTG Pactual’s founder and de facto head sits on Conservation International’s board. Iuri Rapoport, head of ESG at BTG Pactual, is also president and chairman of Conservation International Brazil’s Deliberative Committee.

When asked about a possible conflict of interest, Wishnie replied: “Their role is entirely independent. Our investment process is based entirely on the assessments of their conservation science teams. They’re very rigorous and based on data and the best conservation science.”

Promises of carbon storage

Buying up the region’s deforested cattle ranches is an effort to replace degraded pastures with planted forests, storing carbon and mitigating climate change, said Wishnie.

But according to a landmark 2019 Nature study, land put aside for natural forest regeneration will hold 40 times more carbon than plantations by 2100. After a timber harvest, the carbon stored in plantations will return to the atmosphere as the products become waste and decompose. Worldwide, 45% of all reforestation commitments involved planting vast for-profit monocultures. In Brazil, it’s 82%.

Wishnie added that the reforestation project is aimed at growing larger and more mature trees for furniture rather than pulp in the future. And despite opening an office next to the world’s soon-to-be largest pulpwood factory, he said the company hopes to open its own processing unit to produce wood products rather than pulp and paper.

Solid wood can store carbon, but van der Mark said this effect is overblown.“It’s mostly toilet paper and packaging that will go to waste in no time. Then all the carbon will be emitted again, so there was no real carbon capture,” she said. “This idea that they will all be made into furniture that will exist for 100 years is, of course, not the reality.”

Banner image: Image by Rhett A. Butler for Mongabay.

Citations:

Impact Report 2021. (2021). Retrieved from BTG Pactual, Timberland Investment Group website: https://timberlandinvestmentgroup.com/wp-content/uploads/2023/04/TIG-2021-Impact-Report.pdf

Scorching the Earth: The impacts of pulp and paper expansion in the Três Lagoas region, Brazil (4). (n.d.). Retrieved from Environmental Paper Network website: https://environmentalpaper.org/wp-content/uploads/2022/12/20221215-scorching_the_earth_eng.pdf

Lewis, S. L., & Wheeler, C. E. (2019). Regenerate natural forests to store carbon. Nature Comment. Retrieved from https://media.nature.com/original/magazine-assets/d41586-019-01026-8/d41586-019-01026-8.pdf

Related reading

Still time to save Brazil’s Cerrado, study shows, but it’s running out fast

In Brazil, scientists fight an uphill battle to restore the disappearing Cerrado savanna

FEEDBACK: Use this form to send a message to the author of this post. If you want to post a public comment, you can do that at the bottom of the page.